Prime Minister Philip J Pierre’s Tax Revelation Undermines Trust in Government’s Fiscal Transparency

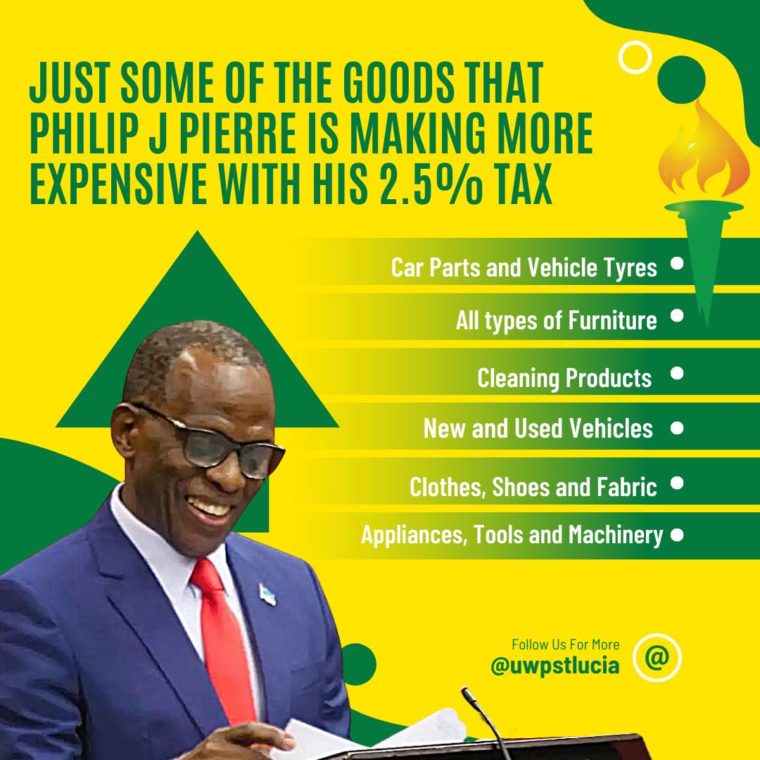

Prime Minister Philip J Pierre of Saint Lucia has come under fire for misleading the public regarding the purpose of a new 2.5% tax. Initially presented as a dedicated source of funding for health and security initiatives, Pierre has now revealed that the tax was implemented to meet the requirements for accessing a $100 million loan from the Caribbean Development…