In March 2020, under the administration of the United Workers Party (UWP) led by the Hon. Allen M. Chastanet, Saint Lucia witnessed a significant milestone in its healthcare landscape with the commencement of the transition to the Owen King EU Hospital (OKEU). Four years on, it’s an opportune moment to reflect on the impact of this transition and the strides…

Saint Lucia has yet again found itself embroiled in a constitutional crisis of alarming proportions, sparked by the Philip J Pierre-led Government’s audacious attempt to appoint a Deputy Speaker in an unconstitutional manner. This blatant disregard for the rule of law and democratic principles raises grave concerns about the integrity of the parliamentary process and the stability of governance in…

Leader of the Opposition Hon. Allen Chastanet has written to the Attorney General of Saint Lucia Mr. Leslie Mondesir expressing concern over a potential violation of the constitution. This concern arises from the government’s reported intention to appoint an unelected individual as Deputy Speaker.

Open letter to Richard FrederickBy Francis Emmanuel Last Thursday I had the misfortune of turning on to MBC hearing Frederick spill more lies than he did prior to the 2021 elections but above all, displaying his hatred for Allen Chastanet as usual. We were taken aghast by his comparison of Allen Chastanetconcerning each others accomplishments. Frederick’s claim to fame is…

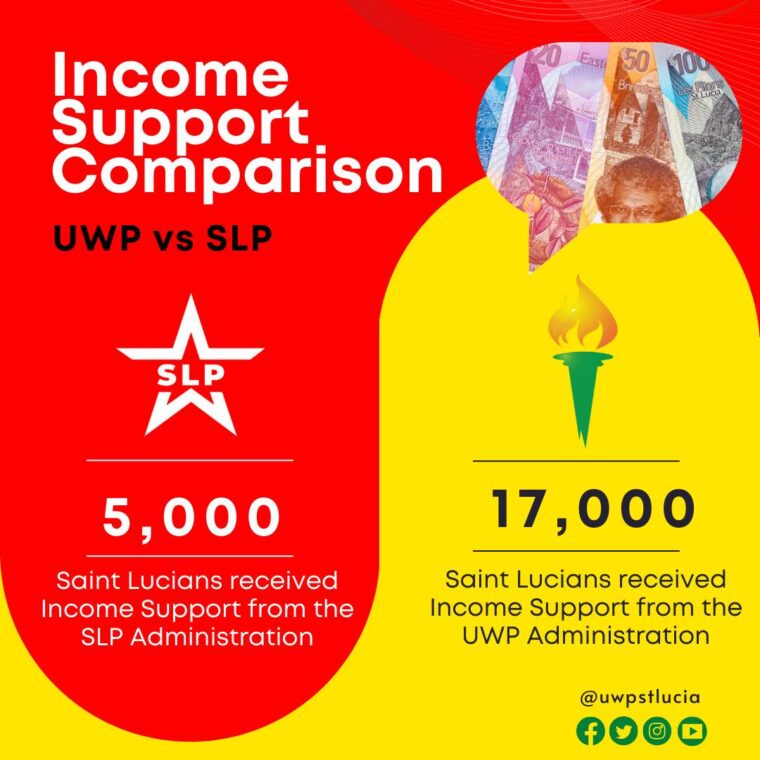

Another of Prime Minister Philip J Pierre’s Broken Promises Exposed: The Truth Behind Income Support

During the 2021 Election campaign, Prime Minister Philip J Pierre made a bold promise to the people of this nation: $1500 income support for all Saint Lucians. However, as time unfolds, it has become evident that this promise was nothing more than a political ploy, a hollow attempt to sway the electorate without any real intention of follow-through. Pierre’s failure…

As leaders, transparency and accountability are paramount in fostering trust and confidence among the public. However, recent revelations regarding Prime Minister Philip J Pierre’s undisclosed trips have sparked criticism and raised serious questions about his commitment to openness and accountability. In the first months of the year, Pierre embarked on two undisclosed trips, keeping his travel itinerary hidden from the…

Prime Minister Philip J Pierre’s Tax Revelation Undermines Trust in Government’s Fiscal Transparency

Prime Minister Philip J Pierre of Saint Lucia has come under fire for misleading the public regarding the purpose of a new 2.5% tax. Initially presented as a dedicated source of funding for health and security initiatives, Pierre has now revealed that the tax was implemented to meet the requirements for accessing a $100 million loan from the Caribbean Development…

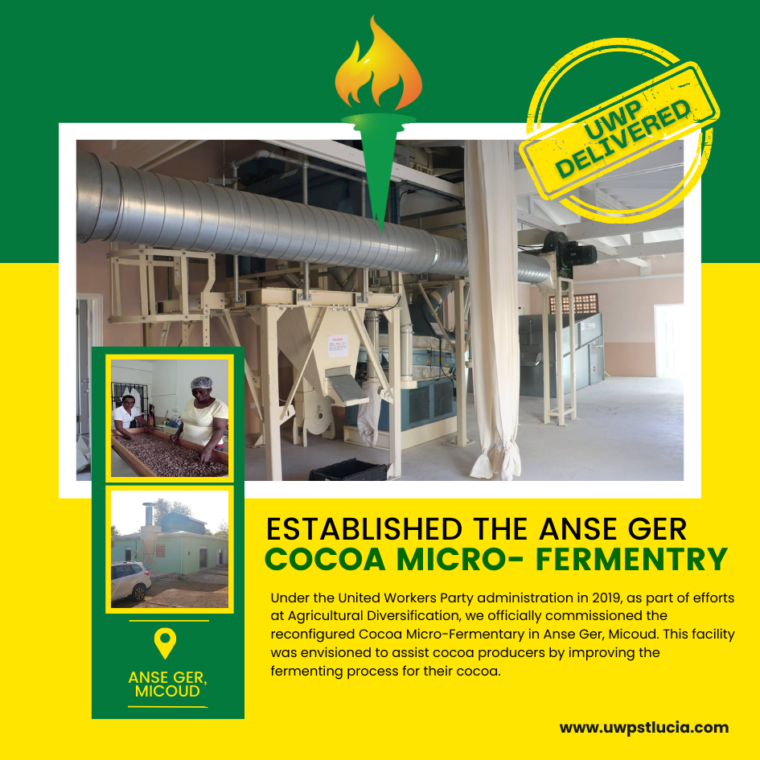

Under the United Workers Party administration in 2019, as part of efforts at Agricultural Diversification, we officially commissioned the reconfigured Cocoa Micro-Fermentary in Anse Ger, Micoud. This facility was envisioned to assist cocoa producers by improving the fermenting process for their cocoa.

In the wake of increasing crime rates, the response of Prime Minister Philip J Pierre has drawn significant criticism. His repeated deflection, citing that he is “not a policeman” and referencing his father’s role as a policeman, has raised concerns about his understanding of the responsibilities inherent in his position as the Minister for National Security. This recurring excuse does…