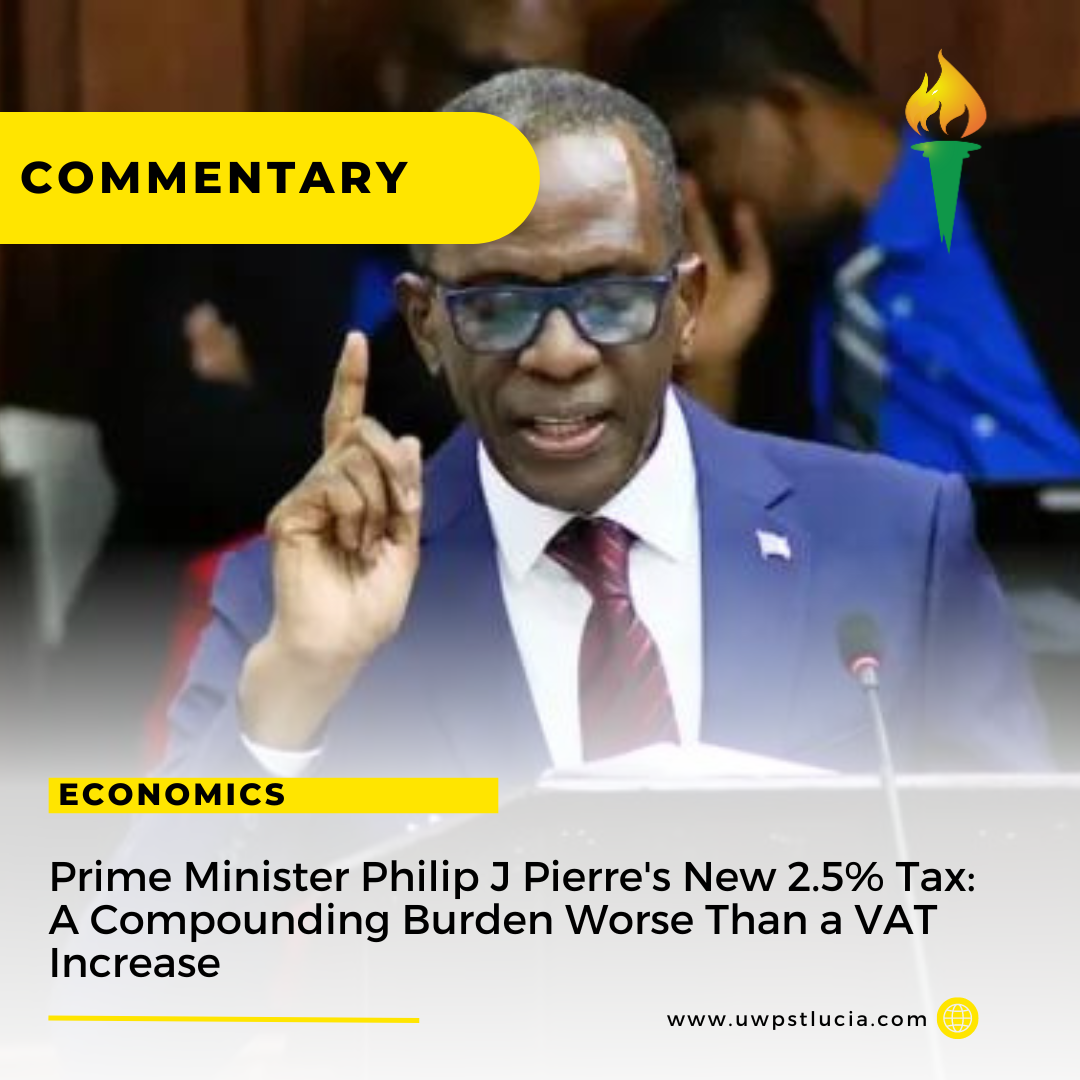

Unlike traditional VAT, which is applied as a percentage of the final sale price of goods or services, the 2.5% tax introduced by Prime Minister Pierre compounds on top of other taxes such as VAT.

Tax Scenario #1: Item costs $100.00 with 15% VAT the total cost would be $115.00

Tax Scenario #2: Item costs $100.00 + 12.5% VAT brings it to $112.50 + 2.5% Tax = $115.31

As you can see based on Philip J Pierre’s new tax, consumers will pay $0.31 more on every $100 spent than if VAT were increased to 15%

Everyday necessities, such as food, clothing, and utilities, will become more expensive, placing an additional burden on households already grappling with rising costs of living. This regressive nature of the compounding tax disproportionately affects low-income individuals and families, who have limited means to absorb the increased financial strain. #PuttingYouWorse#PierreEhCare#LabourPains