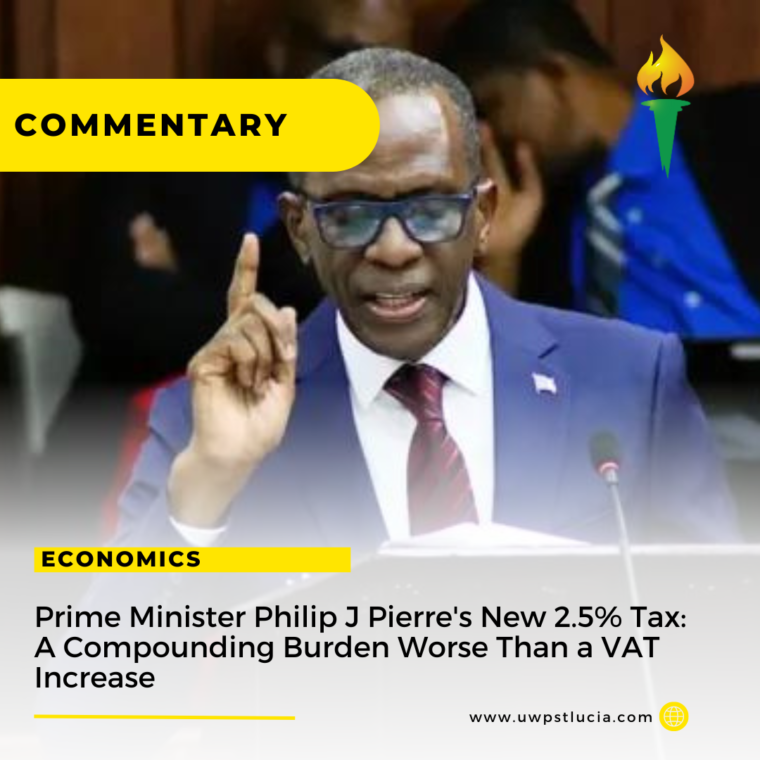

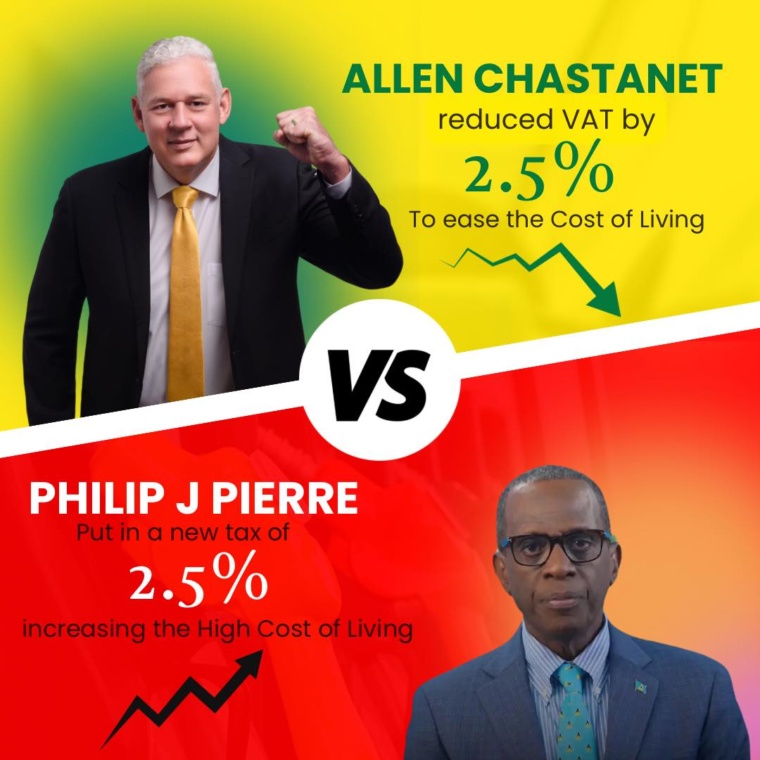

The implementation of a new 2.5% tax on goods and services effective July 1st, 2023 has the potential to significantly impact the poor and vulnerable, particularly in the midst of an inflation crisis. With the government failing to provide any substantial support for those most in need, the additional burden of this tax will push many people further into poverty.

Inflation refers to the general increase in prices of goods and services over time, which results in a decrease in purchasing power. In the current economic climate, inflation rates have been on the rise, and this has hit the poor the hardest. This is because they typically have less disposable income, and the cost of basic necessities such as food, housing, and healthcare make up a larger proportion of their budget.

The introduction of Philip J Pierre’s new tax on goods and services could exacerbate the situation for the poor. A 2.5% tax may not seem like much, but for people living in poverty, every penny counts. This tax will increase the cost of goods and services, and this additional cost would need to be absorbed by the consumer. This would lead to a further decrease in purchasing power for the poor, making it even more difficult for them to afford basic necessities.

The impact of this tax would be particularly significant for those who are already vulnerable. This includes individuals who are unemployed, elderly, or have a disability. These groups typically have a lower income and are more reliant on social welfare programs, which may not be sufficient to cover the increased cost of goods and services.

In the absence of such support measures, the new tax on goods and services could have dire consequences for the poor and vulnerable. It could lead to a further increase in poverty rates, exacerbating existing inequalities and widening the gap between the rich and poor.

Poor Jab the people of Saint Lucia! #PuttingYouWorse #PierreEhCare