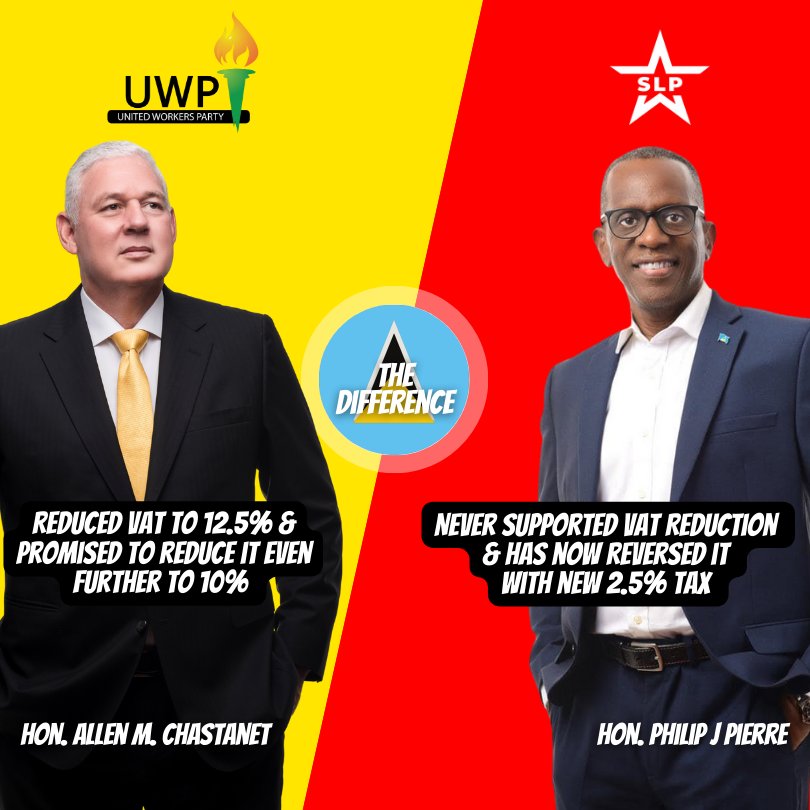

The economic policies of a government can significantly impact the lives of its citizens. One area that often garners attention is taxation. In this article, we will compare the leadership approaches of former Prime Minister Allen Chastanet, who reduced the Value Added Tax (VAT) in Saint Lucia from 15% to 12.5% and promised further reductions, and current Prime Minister Philip J Pierre, who opposed the VAT reduction and implemented a new 2.5% tax.

Chastanet’s VAT Reduction:

During his tenure as Prime Minister, Allen Chastanet introduced a notable economic reform by reducing the VAT rate from 15% to 12.5%. This reduction aimed to stimulate economic growth, alleviate the burden on consumers, and attract investments. Chastanet’s decision was welcomed by many, as it provided immediate relief to individuals and businesses, promoting increased spending and investment opportunities.

Moreover during the 2021 campaign, Chastanet promised to reduce the VAT rate even further to 10% within his first 100 days in office. This pledge demonstrated his commitment to prioritizing the economic well-being of the population and his belief in the power of lower taxes to drive economic prosperity.

Pierre’s Opposition to VAT Reduction:

In contrast to Chastanet’s approach, Prime Minister Philip J Pierre expressed opposition to the VAT reduction during his time in opposition and continued to maintain this stance after assuming office. Instead of pursuing a further reduction in VAT, Pierre decided to implement a new 2.5% tax. This move has been met with criticism and skepticism from various sectors of society.

Critics argue that the introduction of a new tax negates the benefits of Chastanet’s VAT reduction and will place an additional burden on consumers and businesses. They contend that the new tax, coupled with existing taxation measures, will lead to a cumulative effect that stifles economic growth and adversely affects the spending power of individuals.

The divergent approaches of former Prime Minister Allen Chastanet and current Prime Minister Philip J Pierre on VAT reduction reflect their differing philosophies regarding economic management. Chastanet’s decision to reduce the VAT rate aimed to provide immediate relief to citizens and foster economic growth. In contrast, Pierre’s opposition to VAT reduction and introduction of a new tax signals a man who cares more about the Government purse than the people whom he serves