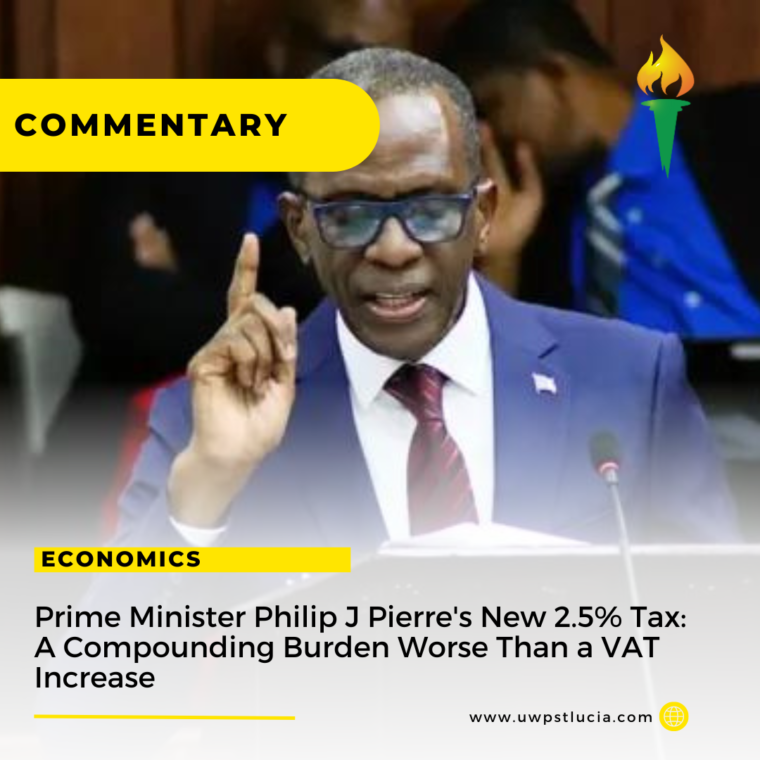

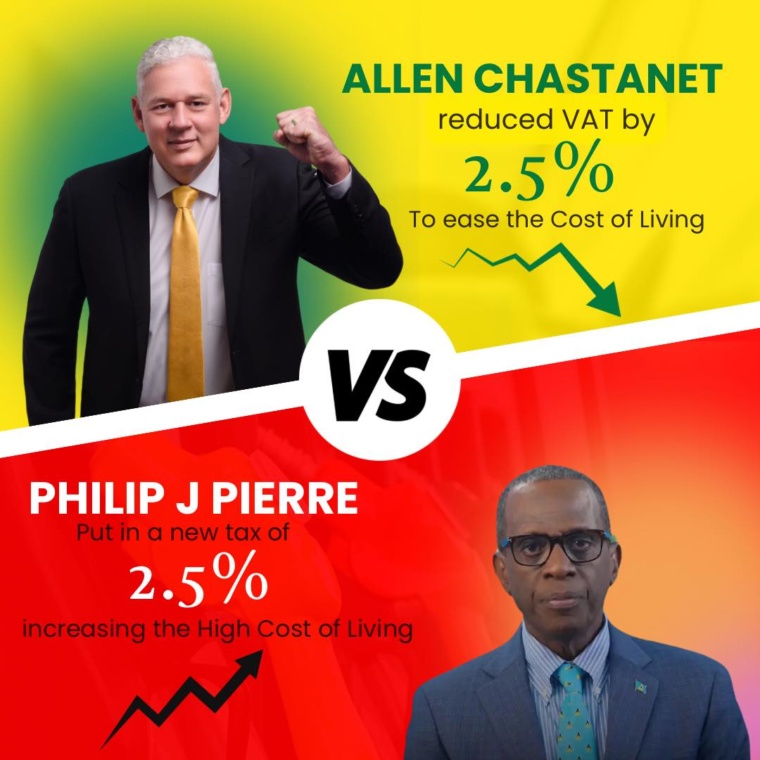

Whilst serving as Prime Minister, Hon. Allen Chastanet kept his campaign promise and reduced VAT by 2.5% to ease the burden on individuals and households, putting more money in the pockets of Saint Lucians. In contrast, when Philip J. Pierre became Prime Minister, he introduced a new 2.5% Health and Security Levy, which led to higher prices for goods and…

by Content Manager