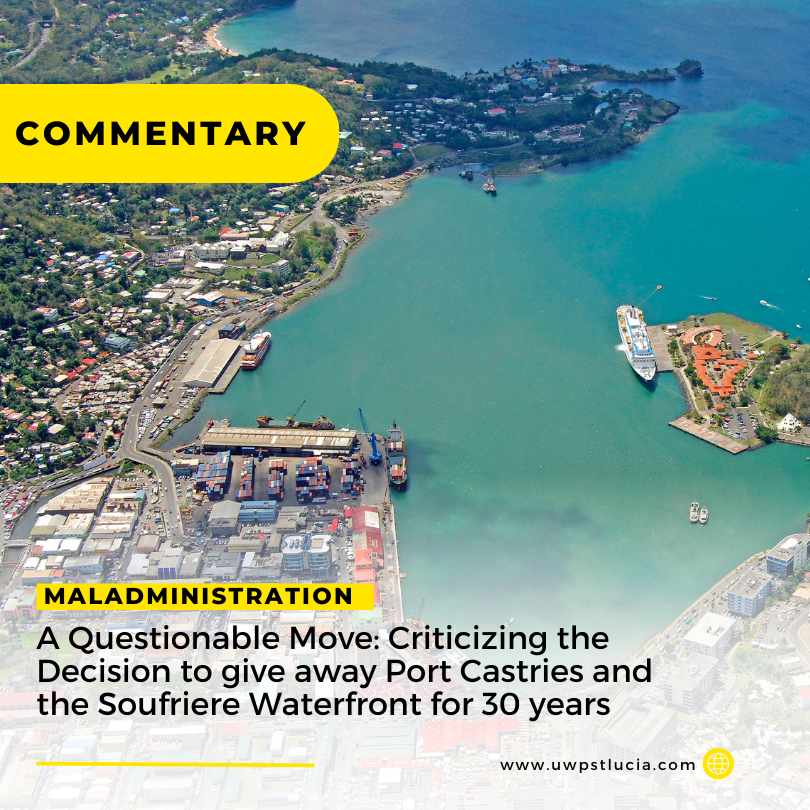

In a recent development that has sparked controversy and concern among citizens, Prime Minister Philip J Pierre’s decision to giveaway Port Castries and the Soufriere Waterfront to a foreign company for 30 years in exchange for a seemingly modest sum of US$42 million has raised eyebrows and ignited debates about the long-term implications for the country’s economy and national assets.

On the surface, a cash influx of US$42 million might appear attractive, but a deeper analysis reveals a lopsided deal that disproportionately favors the foreign developer, potentially costing Saint Lucia a significant amount of money and sovereignty over crucial pieces of its infrastructure.

While the upfront payment may provide a temporary boost to the nation’s finances, it’s essential to consider the long-term benefits that Port Castries and the Soufriere Waterfront could generate if they remained under public ownership and control. These assets are vital economic drivers, holding the potential to generate ongoing revenue through tourism, trade, and various commercial activities. By giving them out for three decades, the government will be sacrificing sustained income for a one-time cash infusion.

The terms of the deal raise concerns over the fairness of the arrangement. The developer’s projected earnings of at least EC$578,880,000 over the 30 year period highlight a significant disparity between the foreign company’s potential profits and the modest upfront payment. Such an imbalance suggests that Saint Lucia might be undervaluing its own assets, potentially losing out on substantial economic benefits that could contribute to the nation’s growth and development. #PierreEhCare#PuttingYouWorse

More allegations of Corruption emerge relating to Saint Lucia’s Citizenship by Investment Programme

Saint Lucians should be deeply concerned regarding the recent revelations made by an Enhanced Due Diligence and Financial Crime Consultant about Saint Lucia’s purported violation of American sanctions on Russia. The consultant’s report accuses Saint Lucia of circumventing U.S. sanctions imposed in response to Russia’s invasion of Ukraine by continuing to process Citizenship by Investment (CBI/CIP) applications for Russian nationals,…

Read more

by Content Manager